Form 1095-B Line by Line Filing Instructions for Employers

ACAwise, a customized ACA Reporting solution, generates ACA Forms with Line 14, 16 codes and e-files them with the IRS / State and distributes employee copies. Learn More

Form 1095-B Filing Instructions -

An Overview

- Updated December 07, 2022 - 8.00 AM by Admin, ACAwise

When the Affordable Care Act (ACA) was passed, the IRS designed Section 6055 of the Internal Revenue Code as a way to gather information on the health insurance coverage that is being offered to individuals.

Under IRC Section 6055, the IRS requires health coverage providers including insurers and small employers to file ACA Forms 1095-B and 1094-B to the IRS and distribute copies of ACA Forms to their employees.

The following instructions summarize what employers must know about the ACA Form 1094-B and Form 1095-B filing requirements.

What is the purpose of ACA Form 1095-B?

Form 1095-B is used to report health coverage information to the IRS regarding individuals who are covered by minimum essential coverage.

Eligibility for certain types of minimum essential coverage can affect a taxpayer's eligibility for a premium

tax credit.

Who must file ACA Form 1095-B?

Every person that provides minimum essential coverage to an individual during a given calendar year must file an information return reporting this coverage.

Government employers that offer employer-sponsored self-insured health coverage to non-employees may use Form 1095-B, rather than Form 1095-C, Part III, to report coverage for their enrolled individuals and their family members.

Small employers, with less than 50 full-time and full-time equivalent employees, aren't subject to the employer shared responsibility provisions. However, any small employers who sponsor self-insured group health plans must use Forms 1094-B and 1095-B to report information about their covered individuals.

Filers must use transmittal Form 1094-B to submit Forms 1095-B.

What is the deadline to file ACA Form 1094 and 1095-B?

Any health coverage providers who offer minimum essential coverage to an individual should furnish a copy of

ACA Form 1095-B to the individuals by March 01, 2024.

Health Coverage Providers must also file ACA Forms 1094-B and 1095-B to the IRS by April 01, 2024, if you choose to file electronically. The Form should be filed by February 28, 2024, if filing on paper.

Click here for the state filing deadlines.

Instructions on How to Fill Out Form 1095-B?

The following information is needed when filing ACA Form 1095-B

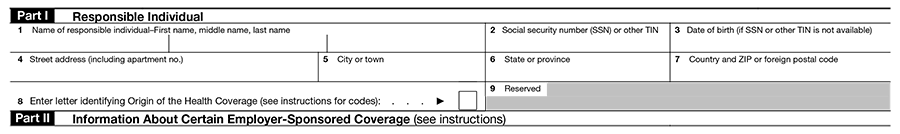

1. Instruction to complete Part I, Responsible Individual

Before proceeding further to fill the offer of health coverage details, the IRS requires you to complete a few basic information about the individuals.

You will need the following information to complete Line 1-9 in Part I of Form 1095-B.

- The individual’s basic information such as their Name, SSN, Date of Birth, Address

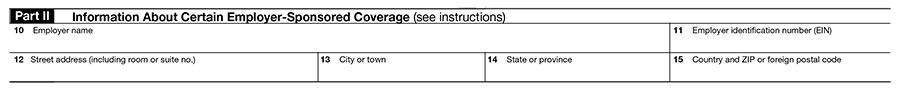

2. Instruction to complete Part II, Information About Certain Employer-Sponsored Coverage

This part II is filed only by issuers or carriers of insured group health plans, including coverage purchased through the SHOP.

You will need the following information to complete Line 10-15 in Part II of Form 1095-B.

- The employer’s basic information such as their Name, SSN, Date of Birth, Address for the employer sponsoring the coverage

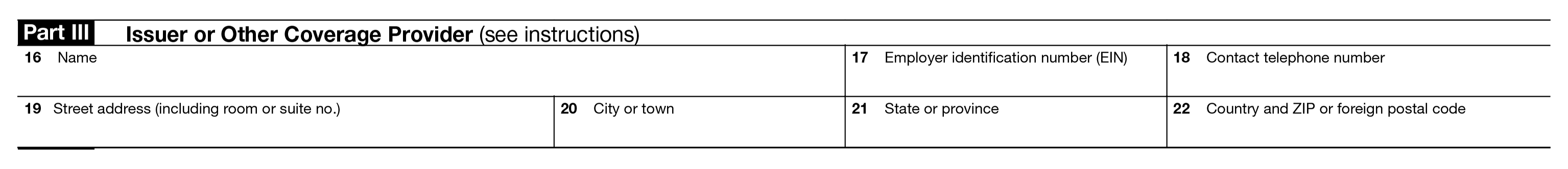

3. Instruction to complete Part III, Issuer or Other Coverage Provider

You will need the following information to complete Line 16-22 in Part III of Form 1095-B.

- The Issuer’s basic information such as their Name, SSN, Date of Birth, Address

The provider of the coverage is the issuer or carrier of insured coverage, sponsor of a self-insured employer plan, government agency providing government-sponsored coverage, or other

coverage sponsor.

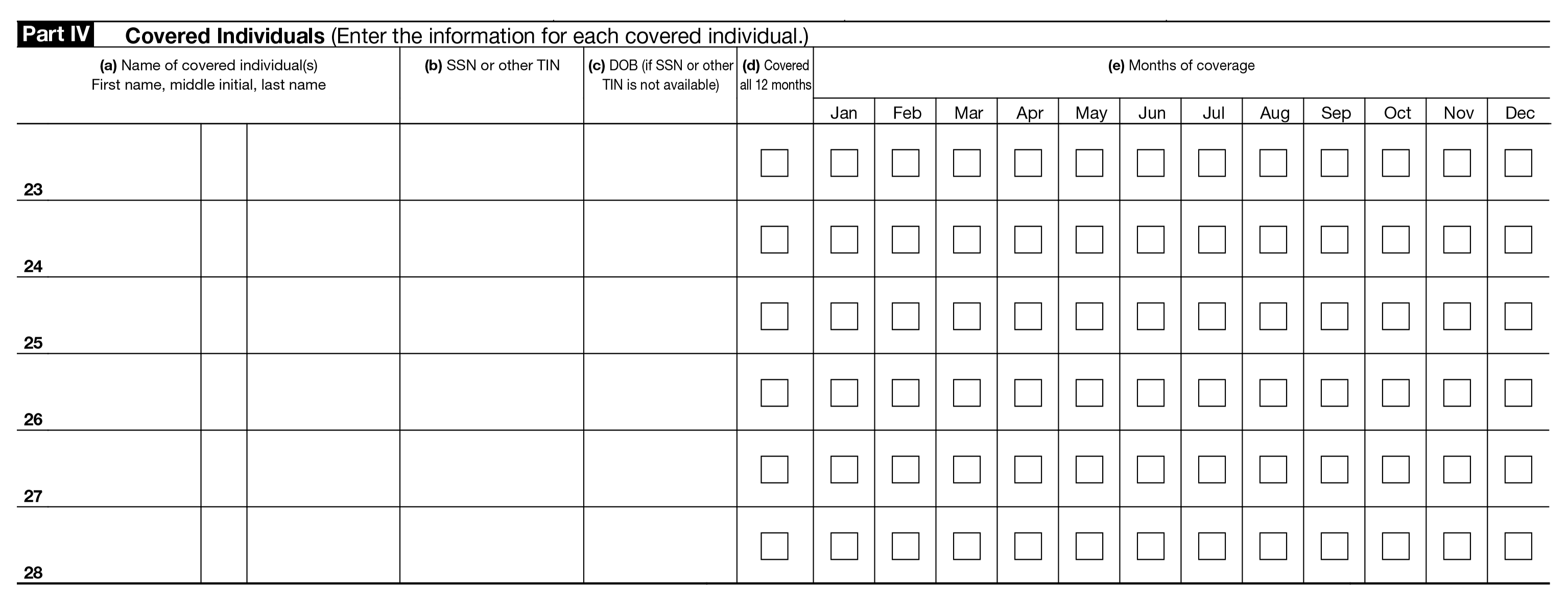

4. Instruction to complete Part IV, Covered Individuals

-

You will need the following information to complete Line 16-22 in Part III of Form 1095-B.

- The covered individual’s details such as their Name, SSN, month of coverage offered

There are 5 Columns in Part IV of Form 1095-B

- Column a - Enter the name of each covered individual.

- Column b - Enter the nine-digit SSN or other TIN for each covered individual (111-11-1111)

- Column c - Enter a date of birth (YYYY/MM/DD) for the covered individual only if an SSN or other TIN isn't entered in column (b).

- Column d - Check this box if the individual was covered for at least 1 day per month for all 12 months of the calendar year.

- Column e - If the individual wasn't covered for all 12 months, check the applicable box(es) for the months in which the individual was covered for at least 1 day.

Requirements for reporting ICHRA on ACA Form 1095-B

New regulations regarding ICHRAs have been introduced in the past year and in turn, these plans are increasing in popularity among employers.

An ICHRA is an employer-sponsored reimbursement plan, which allows employees to purchase their health insurance plan either privately or on the open market. Then, the plan reimburses the employee to help them cover a portion of their medical costs and/or premiums.

To better track these plans and ensure the affordability for employees, the IRS has added a new line to Form 1095-B to report this information.

A new type of coverage code to report ICHRA on Form 1095-B

A new code G must be entered on Form 1095-B, line 8 to identify an ICHRA.

How to File ACA Form 1095-B?

The ACA Form 1095-B can be filed either electronically or by paper with the IRS.

However, the IRS encourages organizations to file electronically. By E-filing, the IRS can process your returns at a faster rate and you can learn the status of your submission instantly.

Choose an Electronic filing method for quick, secure, and accurate filing. E-file ACA Form 1095-B Now

If you choose to paper file ACA Form 1095-B, download the ACA Form 1095-B, fill in the necessary details, and then send it to the IRS by the address mentioned here.

Filing Form 1095-B Electronically

Choose the ACA Reporting vendor like ACAwise to take care of e-filing your ACA Form 1095-B!

ACAwise is a comprehensive ACA reporting solution provider that can help you to get started with your

ACA reporting now.

ACAwise helps to e-file your ACA Form 1095-B with the IRS, State and distribute the 1095 copies to your employees on-time. ACAwise is equipped to handle special scenarios such as ICHRA, COBRA, Rehire, terminated, etc.

Let us take care of your ACA Reporting!

We file your 1094/1095 Forms with the IRS and postal mail the copies to employees before the deadline.

Browse By Topics

×- ACA Reporting Deadline

- 1095-C Code Sheet

- Form 1095-C Instructions

- Form 1095-B Instructions

- ACA Vendor Checklist

- 2020 ACA Penalties

- ACA Requirements

- Letter 5699

- Letter 226J

- 2020 Revised ACA Form

- Form 1095-C

- Form 1095-B

- ICHRA Affordability 2020

- Notice CP220J

- ACA Full-Time Employees

- Penalty Notice 972CG